Basic Policy on Shareholder Returns

The Company will return profits to shareholders based on the assumption that its businesses, particularly the redevelopment and building leasing businesses, will operate stably over the long term, and sufficient internal reserves for raising shareholder value will be secured. As a basic policy, the Company will aim for a consolidated total shareholder return ratio of 70% from fiscal 2020 to 2023 by drawing from returns on business investments while placing importance on the cost of capital and capital efficiency.

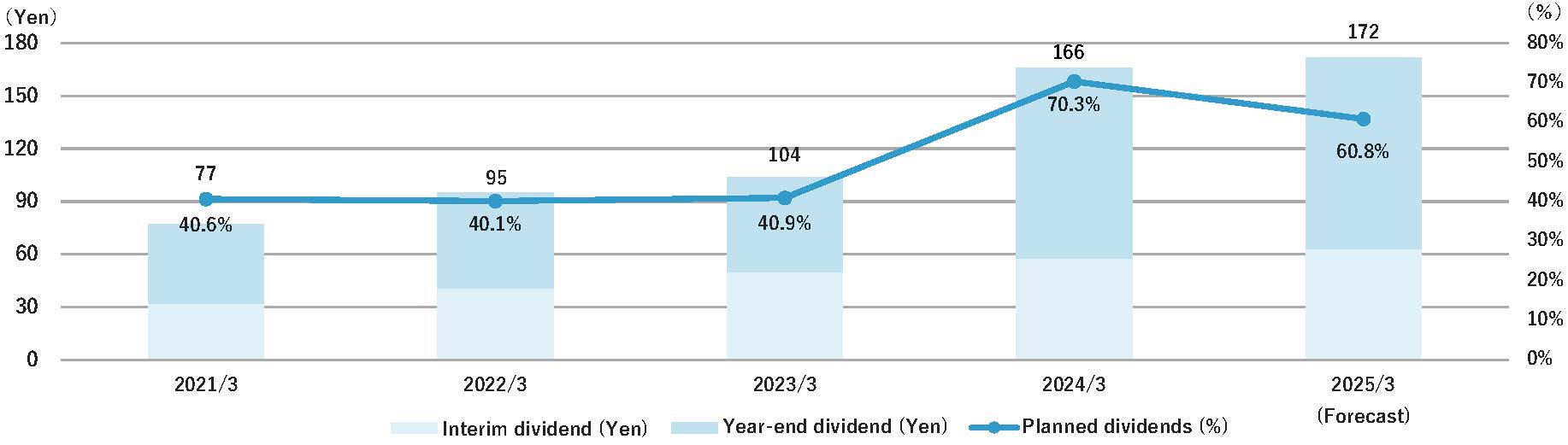

Paid and Planned Dividends

Note: The forecasts and other forward-looking statements stated in this reference material were compiled based on information available to the Company and certain assumptions considered reasonable at the time this material was compiled. Accordingly, we have no intention of guaranteeing that the views will become reality. Actual results may differ significantly from these forecasts due to various factors, including changes in our business environment.

Note: Year-end dividend for the fiscal year ended March 31, 2024, is ¥108.0 per share, comprisinged of ordinary dividends totaling ¥58.0 per share and the special dividend of ¥50.0 per share.

Note: Year-end dividend for the fiscal year ended March 31, 2025, is ¥109.0 per share, comprisinged of ordinary dividends totaling ¥63.0 per share and the special dividend of ¥30.0 per share.(Forecast)

The Status of Own Shares Repurchases