Basic approach to corporate governance

Corporate governance is a top priority for us.

We strive for rigorous corporate governance across the group so that we can earn the trust of our shareholders and other stakeholders and conduct our business impartially and effectively.

Corporate governance principles

We have established the following corporate governance principles, which reflect the principles of Japan’s Corporate Governance Code.

- We protect the rights and ensure the equitable treatment of all shareholders. We strive to create a climate in which all shareholders can duly exercise their rights.

- We recognize that our sustainable growth and mid-to-long-term value depend on us engaging and cooperating with stakeholders, including our shareholders, employees, customers, trading partners, creditors, and the local communities we serve. We foster a corporate culture that respects stakeholder rights and emphasizes sound business relationships with them.

- We disclose financial and non-financial information when required to do so by law. Even when disclosure is not mandated, we voluntarily disclose any information that could affect the investment decisions of shareholders or other investors.

- We understand that members of the Board of Directors are accountable to shareholders. To promote sustainable growth and enhance mid-to-long term corporate value, the board provides effective oversight of the management, ensuring that the management takes reasonable risks and that it contributes to the company’s profitability.

- To promote sustainable growth and enhance mid-to-long term corporate value, we actively engage in constructive dialogue with shareholders and other stakeholders. To earn stakeholders’ support and confidence, members of the Board of Directors actively listen to stakeholders and relay their feedback to the management, while ensuring that our corporate strategy is clear and transparent to stakeholders.

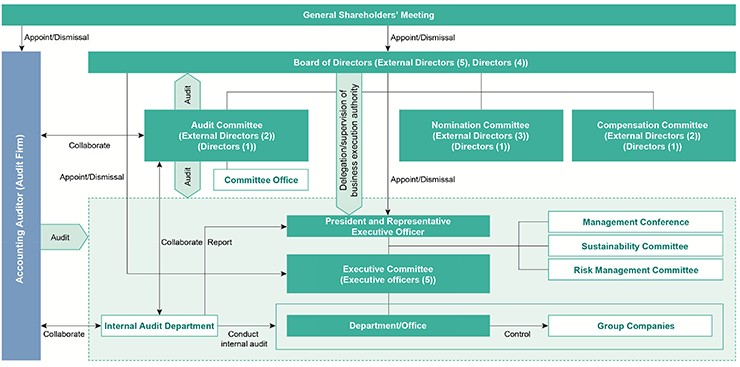

Corporate Governance System

- Board of Directors

The Board of Directors consists of nine (9) directors (including one (1) female director) and is chaired by the executive officer, president and CEO.

The Board of Directors decides on basic policies of management and supervises business execution by directors and executive officers.

The Board of Directors passes resolutions on the matters specified under laws and regulations and the Regulations of the Board of Directors’ meetings and delegates the execution of other business to the executive officers.

The number of members of the Board of Directors is limited to eleven (11) as stipulated in the Articles of Incorporation, and a majority of these are independent external directors.

When appointing directors, in addition to considering diversity of gender and size, the Company will appoint directors in consideration of appropriate combination according to the business environment and business characteristics, after identifying required skills, etc. regarding the knowledge, experience, abilities, etc. that directors should have in light of the Company's management strategy. In addition, the Company has set a rule that external directors shall include those who have management experience at other companies. - Nominating Committee

The Nominating Committee is composed of three (3) or more committee members chosen by the Board of Directors, and from the viewpoint of ensuring independence and objectivity, the chairperson of the Committee shall be an external director.

The Nominating Committee decides on the content of proposals related to election and dismissal of directors to be submitted to the general shareholders’ meeting, and formulates the standards for election and dismissal of directors.

The Nominating Committee expresses opinions regarding the matters relating to the election and dismissal of executive officers and the succession plan for the executive officer, president and CEO upon consultation with the Board of Directors or with the executive officer, president and CEO.

The Company will disclose the reasons for the election and dismissal of the senior top management and the election, dismissal and appointment of the individual candidates for directors upon the election, dismissal and appointment thereof. - Audit Committee

The Audit Committee is composed of three or more committee members chosen by the Board of Directors, and from the viewpoint of ensuring independence and objectivity, the chairperson of the Committee shall be an external director. Furthermore, from the perspective of enhancing the audit function, a statutory Audit Committee member will be selected.

The Audit Committee audits business execution by directors and executive officers, prepares audit reports, and decides on the content of proposals related to appointment, dismissal and non-reappointment of independent auditors. - Compensation Committee

The Compensation Committee is composed of three (3) or more committee members chosen by the Board of Directors, and from the viewpoint of ensuring independence and objectivity, the chairperson of the Committee shall be an external director.

The Compensation Committee decides on policy related to decisions on the content of compensation, etc. for directors and executive officers individually, and decides on the content of compensation, etc. for directors and executive officers individually. - Meeting of Executive Officers

The Meeting of Executive Officers shall consist of Five (5) executive officers. Its agenda is managed by the executive officer, president and CEO. In addition to executing important business operations, it conducts prior deliberation on matters to be submitted to the Board of Directors. - Management Conference

The Management Conference consists of the executive officer, president and CEO and executive officers, with its agenda managed by the executive officer, president and CEO. It discusses the direction of the Company's management strategy and other matters. - Sustainability Committee

The Company has established the Sustainability Committee, which consists of the executive officer, president and CEO as the chairperson, executive officers, managing officers and the heads of each department as the committee members, with the aim of smoothly promoting measures for the practice of sustainability management.

By monitoring the plan-do-check-act (PDCA) cycle for sustainability initiatives, the Sustainability Committee acts to increase the effectiveness of sustainable management. - Risk Management Committee

The Company assigns the executive officer, president and CEO as officers of primary responsibility for risk management, and has established the “Risk Management Committee” that consists of executive officers, managing officers and general managers and endeavors to appropriately grasp the overall risk of the Company Group and deal with any risks that are emerged.

[Skillmatrix]

| Candidate for Director |

Corporate management |

Financial affairs / accounting |

Legal affairs |

International perspective |

Finance / securities |

Planning / sales |

DX / IT |

Committee to be appointed | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Nominating | Audit | Compensation | ||||||||

| Kiyoyuki Tsuchimoto |

● | ● | ● | ● | ● | |||||

| Kazuo Yamada |

● | ● | ● | |||||||

| Takahisa Aoyama |

● | ● | ● | |||||||

| Daisuke Kobayashi |

● | ● | ● | ● | ||||||

| Kiichiro Masui |

● | ● | ★ | |||||||

| Takahiro Moriguchi |

● | ● | ● | ● | ● | ● | ★ | |||

| Junko Utsunomiya |

● | ● | ● | |||||||

| Eiji Yamada |

● | ● | ● | ● | ||||||

| Mitsunobu Yamaguchi |

● | ● | ★ | |||||||

★: Chairperson *This list does not indicate all of the skills possessed by each candidate for Director.

Members of the Board of Directors and their Committee Memberships

| Name | Position | Board of Directors |

Nominating Committee |

Audit Committee |

Compensation Committee |

|---|---|---|---|---|---|

| Kiyoyuki Tsuchimoto | Director | ★ | ● | ● | |

| Kazuo Yamada | Director | ● | |||

| Takahisa Aoyama | Director | ● | |||

| Daisuke Kobayashi | Director | ● | ● | ||

| Kiichiro Masui | External Director | ● | ★ | ||

| Takahiro Moriguchi | External Director | ● | ● | ★ | |

| Junko Utsunomiya | External Director | ● | ● | ● | |

| Eiji Yamada | External Director | ● | ● | ||

| Mitsunobu Yamaguchi | External Director | ● | ★ |

(Note)★ Indicates the chair of each organization, and ● indicates its members

Members of the Meeting of Executive Officers and their Committee Memberships

| Name | Position | Meeting of Corporate Executive Officers |

Management Conference |

Sustainability Committee |

Risk Management Committee |

|---|---|---|---|---|---|

| Kiyoyuki Tsuchimoto | Executive Officer, President and CEO |

★ | ★ | ★ | ★ |

| Kazuo Yamada | Representative and Senior Managing Executive Officer | ● | ● | ● | ● |

| Tomoharu Nakao | Managing Executive Officer | ● | ● | ● | ● |

| Nobuhiro Seo | Executive Officer | ● | ● | ● | |

| Takahisa Aoyama | Executive Officer | ● | ● | ● |

(Notes) 1. ★ indicates the chair of each organization, and ● indicates its members.

2.The Sustainability Committee and the Risk Management Committee are composed of the members indicated in the table above, as well as managing officers and heads of department.

Compensation of Directors and Officers

- Basic approach

- Compensation for directors, executive officers, and managing officers (hereinafter referred to as "executive compensation") shall be provided under the following basic approach in accordance with the principles of the Corporate Governance Code so as to carry out our management policy.

(i) Motivate employees to enhance business performance over the medium to long term and corporate value

(ii) Share value with shareholders

(iii) Establish standards and systems contributing to retaining talented personnel

(iv) Establish decision-making processes ensuring ample objectivity and transparency - Executive compensation consists of fixed compensation as basic remuneration, bonuses as short-term incentives, and performance-linked stock remuneration as medium- to long-term incentives.

- Directors who concurrently serve as executive officers shall only receive compensation for executive officers.

- Compensation for directors (excluding those concurrently serving as executive officers) and managing officers on special appointment managing the secretariat of the Audit Committee shall solely consist of basic remuneration in consideration of their roles and other factors.

- Compensation for directors, executive officers, and managing officers (hereinafter referred to as "executive compensation") shall be provided under the following basic approach in accordance with the principles of the Corporate Governance Code so as to carry out our management policy.

- Policy on determining individual basic remuneration amount (monetary remuneration) including policy on determining remuneration timing and conditions

- Basic remuneration shall be determined through comprehensive consideration of the significance of roles and scope of responsibilities for each position, as well as performance and other factors, founded in the executive compensation system.

- Basic remuneration shall be paid in fixed monthly compensation.

- Policy on determining performance-linked remuneration and non-monetary remuneration details and amount, as well as method for calculation (including policy on determining remuneration timing and conditions)

(1) Bonuses

- Bonuses are paid in cash in June each year as a short-term incentive to raise awareness of the need to improve performance in each fiscal year.

- Bonuses are calculated by multiplying a base amount determined in accordance with position by a coefficient determined in accordance with the achieved level of net income attributable to owners of parent. This amount is then added to the multiplicative product of the monthly fixed compensation for each position and a coefficient determined in accordance with an evaluation of each individual (including ESG evaluation).

The coefficient for net income attributable to owners of parent shall be adjusted within the range of 0% to 150%, while the coefficient for individual evaluation (including ESG evaluation) shall be adjusted within the range of 0% to 100%.

However, the executive officer, president and CEO shall not be paid compensation based on individual evaluation or the associated monthly fixed compensation for each position. - The Compensation Committee has the authority to forgo or reduce bonus payments in cases where an executive officer or managing officer has been dismissed or where they have caused damage to the Company intentionally or through gross negligence, etc.

- Bonuses for managing officers shall be determined in the same manner as bonuses for executive officers.

- Performance-linked stock remuneration shall be paid as medium- to long-term incentives, consisting of a fixed portion and a performance-linked portion.

- The fixed portion is determined based on position, while the performance-linked portion is determined based on the achievement level of performance conditions, stock price level, and other factors.

- The fixed portion is designed to strengthen sharing value with shareholders, while the performance-linked portion is designed to motivate employees to enhance corporate value over the medium- to long-term, as well as business performance, and to strengthen the linkage between business performance and compensation.

- In principle, shares shall be paid at the time of retirement of eligible executive officers and managing officers using a stock compensation trust.

- In the interest of improving performance over the medium- to long-term, evaluation indicators used in the performance-linked portion shall be consolidated operating income, a straightforward indicator of the earning power of our core businesses, and total shareholder return (TSR), an indicator of shareholder return provided as a result of increased corporate value.

- Stock remuneration in the performance-linked portion shall be determined by adjustments within the range of 0% to 150% for each of the achievement level of consolidated operating income versus performance targets and relative evaluation of TSR versus stock indices, respectively.

- The details shall be stipulated in the Share Benefit Regulations determined by a resolution of the Compensation Committee.

- Policy for determination of the ratio of monetary remuneration, performance-linked remuneration, or non-monetary remuneration as a share of total individual director (excluding managing officers) remuneration.

- The ratio of each type of remuneration for executive officers (including those concurrently serving as directors) shall be determined by the Compensation Committee based on the remuneration levels at peer companies and other factors. The following presents general guidelines for ratios when performance targets are achieved.

- Compensation for directors (excluding those concurrently serving as executive officers) shall solely consist of basic remuneration in consideration of their roles and other factors. There is no policy for determination of the ratio of monetary remuneration, performance-linked remuneration, or non-monetary remuneration as a share of total individual remuneration.

(2) Performance-linked stock remuneration

Standard for calculating performance-linked stock remuneration

| Item | Fixed compensation | Bonuses | Performance-linked stock remuneration |

|---|---|---|---|

| Purpose | Basic remuneration | Short-term incentive | Medium- to long-term incentive |

| Ratio of total compensation (Guideline) |

55%–60% | 25%–30% | 15%–20% |

Cross-Shareholdings

The Company maintains cross-shareholdings to strengthening business relationships, as well as to facilitate financial activities and to strengthen business alliances considered to be beneficial for medium- to long-term business development.

Every year, the Board of Directors verifies the appropriateness of individual cross-shareholdings in overall consideration of yields and capital costs, as well as whether they are useful for medium- to long-term business development and are in

line with Company objectives including strengthening business relationships, facilitating smooth financial activities and enhancing business alliances.

If, as a result of this verification, holdings are determined to be inappropriate, they are reduced through disposal by sale after considering for share prices and market trends.

The Company deliberates on each proposal regarding the exercising of voting rights from the perspective of the issuing company’s prospects for sustained growth, corporate value enhancement over the medium- to long-term and increased

shareholder value, while confirming that the issuing company has not engaged in any anti-social acts, been involved in major scandals and that there are no serious concerns regarding corporate governance.

In addition, the Company thoroughly investigates the appropriate reasons, objectives, and other factors regarding proposals that have the potential to affect corporate value and shareholder value, and then determines whether or not to grant

approval.

Proper Information Disclosure and Dialog with Shareholders

- The Company announces the "Policies for the Establishment/Improvement of and Initiatives for the System to Promote Constructive Dialog with Shareholders" approved by the Board of Directors.

- The department in charge of IR ensures information control to prevent the leakage of unannounced important insider information outside the Company through dialog according to the regulations for the control of insider information and the prevention of insider trading.

- To promote sustainable growth and enhance the corporate value in the medium and long term, the Company sets and publishes medium- and long-term goals for capital efficiency, etc. after accurately grasping the capital cost when the Company formulates management strategies and management plans and works to achieve the goals and explains its efforts to that end to shareholders and others.

- From the perspective of sustainable growth and enhancement of corporate value in the medium and long term, the Company has set up its basic policy to carry out appropriate business portfolio management in order to optimize the business portfolio and create synergies.

Corporate Governance Guidelines

A guideline describing the framework of corporate governance.

- Corporate Governance Guidelines(PDF:170KB)

Basic Policy on Controllers for Company Financial and Business Policymaking

If a purchase is proposed by a specific person or persons that may transfer Company control, we believe the final decision to approve or deny this proposal should be made based on the will of all of the Company's shareholders. However, we believe that those people who control the Company's financial and business policymaking must have sufficient understanding of the details of the Group's finances and business as well as the sources of the Company's corporate value, and that they must continuously improve both corporate value and shared profit with shareholders. Some large-scale purchase activities may damage this value and profit that we have built up over time.

Based on this recognition, we believe that the Company's shareholders must be given the opportunity to carefully judge large-scale purchases for the impact they may have on the Company's corporate value or shared profit with shareholders. We believe it is necessary that both the purchaser and the Company's Board of Directors provide essential and sufficient information and opinions to shareholders about the purpose, details, and aforementioned impact of the large-scale purchase in question. We also believe it is necessary for shareholders to be given the essential and sufficient time to consider these; in other words, creating a situation where there is as little coercive force affecting shareholder decision-making as possible.

With this basic concept in mind, the Board of Directors of the Company will require that large-scale purchasers provide the essential and sufficient information for shareholders to make an appropriate decision on the positives and negatives of the purchase in question. This provided information will also be disclosed in an appropriate manner and at an appropriate time, and measures will be taken deemed appropriate within the limits permitted by the Financial Instruments and Exchange Act, the Companies Act, other laws and regulations, and the Articles of Incorporation. The Company designed this policy to ensure that its corporate value and shared profit with shareholders is maximized.