Basic Approach

The Company has put a risk management system in place in order to properly manage and control risks, limit or prevent risks from materializing, and minimize any damage in the event such risks materialize, and smooth control work, minimize damages for corporate resource.

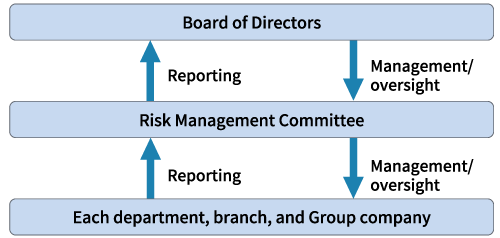

Risk Management Systems

To have an overall understanding of the Group's risks and appropriately take action in the event of their materialization, the Risk Management Committee meets quarterly, chaired by the Executive Officer, President and CEO and comprised of Executive Officers and Managing Officers and heads of each departments, At these meetings, the committee works to understand risks that have materialized within the Group and discusses matters such as how to prevent recurrence. For key matters, the committee reports to the Board of Directors as appropriate, and the system provides for Board oversight of risk management and review of implementation status.

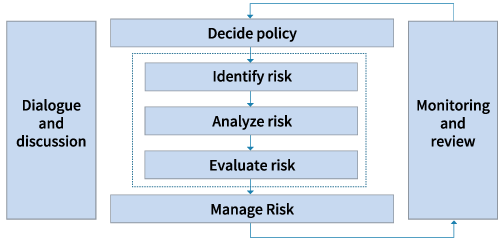

Note that the Risk Management System has been designed with reference to the ISO31000 standard risk management framework.

Schematic Diagram of the Risk Management System

Risk Management Process

We categorize risks as shown below to facilitate their management, in recognition of the importance of proper risk management in the management of the Group. We single out risks that can have a particularly significant impact on the business and require special management as Risks subject to monitoring.

- Real estate risk

- Legal risk

- Financial risk

- Information security risk

- Labor risk (health and safety)

- Overall business risk

- ESG risk (especially climate change and corruption)

The risks discussed below are managed carefully and important matters reported to the Board of Directors for discussion of how to respond.

- Real estate investment risk

For the acquisition and sale of properties, the Investment Risk Working Group meets ahead of discussion by the Board of Directors, analyzing the risks associated with the acquisition or sale and reporting its findings to the Meeting of Executive Officers. - Business Continuity Planning (BCP)

To mitigate the risk of a company crisis in the event of an emergency, we have produced a business continuity plan and a manual based on this plan, and we conduct regular inspections in line with this.

Provisions for Litigation, including Violation of Laws and ESG Issues

As of March 31, 2023, the Company has not booked any important provisions for the possibility of fines or settlements in the future caused by incidents occurring prior to fiscal 2022.

Regular Rotation of Accounting Auditors and Repeat Engagement

Our basic policy on auditing firm rotation combines approaches from the Certified Public Accountants Act and the JICPA rules on ethics.

Prevention of Corruption and Bribery

The Group has enacted the Code of Conduct and the Standards for Behavior for Heiwa Real Estate Group, and drafted a summary of matters to be complied with in order to act with fairness and honesty without violation of social norms. In keeping with these we maintain an awareness of the gravity of our social responsibility, strictly comply with all laws, regulations, and rules, and seek to be a company that has a strong sense of ethics and can keep the trust of society.

The Standards for Behavior for Heiwa Real Estate Group calls on us to strictly refrain from behavior that may seem like collusion from society's standpoint in our relationships with government and administrative bodies; prohibits entertainment, gifts, and other benefits deviating from social conventions; and concretely defines measures to prevent not only bribery, but corrupt behavior in general. These details are published to our intranet and are available for employee viewing at any time.

Corruption Prevention Efforts

- Our systems to prevent corruption and bribery are monitored by the Risk Management Committee and periodic updates are reported to the Board of Directors. We are also taking a number of actions to improve compliance awareness, such as holding at least five compliance training sessions each year for all officers and employees and thoroughly disseminating the contents of various compliance regulations, including those for the prevention of corruption and bribery.

- Furthermore, based on our Internal Reporting Regulations, we have established a compliance hotline at the Company in order for us to rapidly be aware of organizational or individual misconduct or violations of laws and regulations and to take necessary measures in response. This system also promotes ethics and compliance with laws and regulations at Group companies.

- To promote fair transactions with business partners such as corporations, we have also set up an external reporting desk to receive reports on compliance violations and suspected violations by officers and employees of the Group. This system also allows anonymous reporting.

- The Board of Directors and Investment Risk Working Group determine how to handle projects deemed to have a high risk of corruption on a case-by-case basis.

- The Risk Management Committee confirms contracts and outsourcing processes to address the risk of corruption and bribery by outside vendors (brokerage outsourcers and other subcontractors).