- HOME

- IR Information

- Heiwa Real Estate at a Glance

An overview of

Heiwa Real Estate

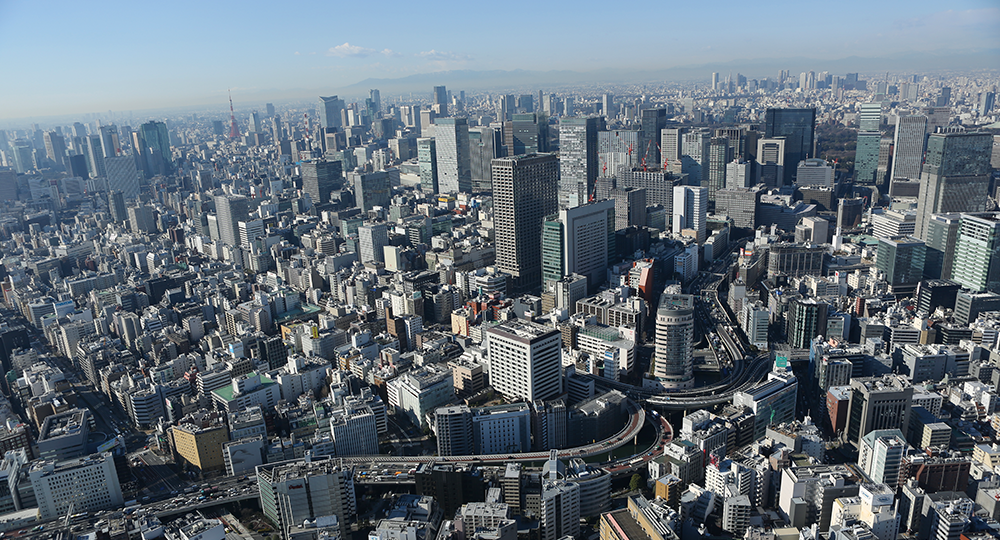

We will contribute to the creation of a global financial city by revitalizing areas.

Heiwa Real Estate was founded as a company that owns and leases stock exchange buildings, and currently owns the Tokyo Stock Exchange Building, the Osaka Securities Exchange Building, the Nagoya Stock Exchange Building, and the Fukuoka Shoken Building.

Supporting Japan’s financial infrastructure, we redeveloped the Osaka Securities Exchange Building, the Nagoya Stock Exchange Building by establishing relationships of trust with various stakeholders to obtain their cooperation. We have also launched the first phase of the Nihonbashi Kabutocho and Kayabacho Revitalization Project.

We are leveraging the features of Nihonbashi Kabutocho, which is home to a securities market, to revitalize this district over the medium and long term. In doing so, we will contribute to the “Global Financial City: Tokyo” vision as we fulfill our social responsibility of contributing to the future of Nihonbashi Kabutocho and Kayabacho.

Ownership of Stock Exchange Buildings throughout Japan

-

Tokyo Stock Exchange Bldg. -

Osaka Securities Exchange Bldg. -

Nagoya Stock Exchange Bldg. -

Fukuoka Shoken Bldg.

A Building Leasing Business in Japan’s Major Cities

Heiwa Real Estate’s

businesses

Reaching for new heights as a company that contributes to revitalizing areas

Our business is centered on three core businesses: the Redevelopment Business, which promotes the revitalization of the Nihonbashi Kabutocho and Kayabacho district as well as the commercialization of redevelopment in Sapporo, the Building Business, which conducts building leasing in major cities across Japan, and the Asset Management Business which provides HEIWA REAL ESTATE REIT, Inc.'s Growth support.

Heiwa Real Estate’s

financial performance

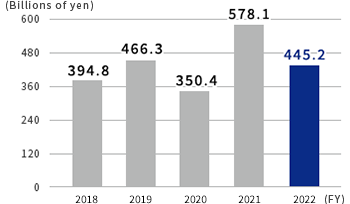

Recent business performance

-

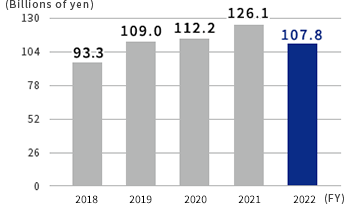

Operating Revenue

-

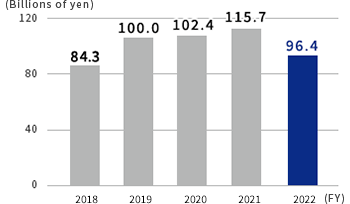

Operating Income

-

Ordinary Income

-

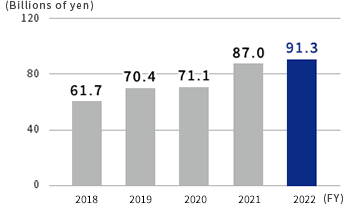

Net Income Attributable to Owners of Parent

Heiwa Real Estate’s

growth strategies

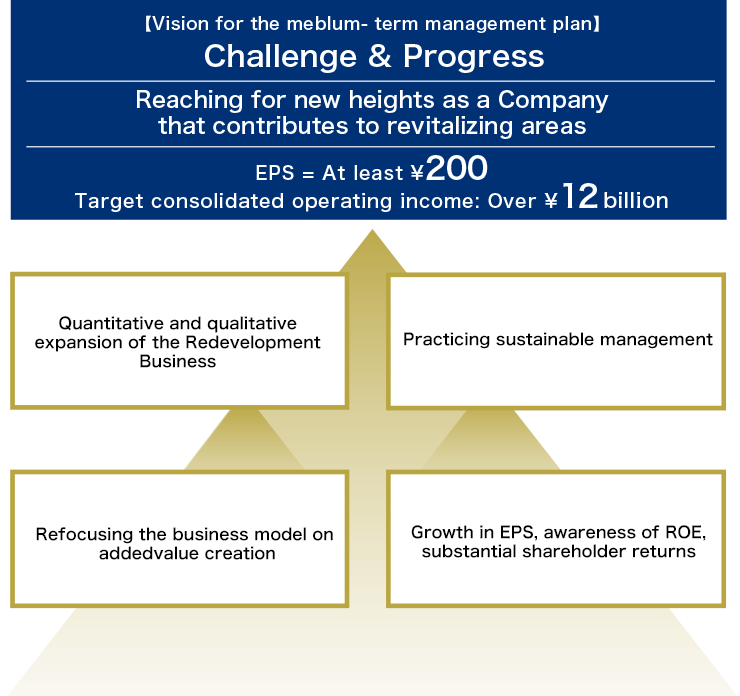

Positioning of the new Medium-term Management Plan “Challenge & Progress”

(Fiscal 2020–Fiscal 2023)

The new plan is positioned as a period for tackling the challenge of, and making progress in, the vision of becoming a company that contributes to revitalizing districts, by helping to make our society better positioned to address the social issue of sustainability, as well as refocusing our business model on added-value creation through external and internal growth, commercialization of the Sapporo redevelopment, and revitalization of Nihonbashi Kabutocho and Kayabacho.

Heiwa Real Estate and Tokyo’s

Nihonbashi Kabutocho and Kayabacho district

A district where people connect, and where investment and growth are born

Supporting Japan’s financial infrastructure, by establishing relationships of trust with various stakeholders to obtain their cooperation, we have also launched the first phase of the Nihonbashi Kabutocho and Kayabacho Revitalization Project.

Since the Meiji era, Kabutocho has been an entrepreneurial district for investment and securities, a district where innovation has been in step with the times, where investors have gathered and where a broad array of information has been exchanged. This historical background and other factors were the basis for our concept of a district where people connect, and where investment and growth are born. Our goal is revitalization that is unique to Kabutocho by harmonizing Kabutocho’s potential with neighboring districts.

Heiwa Real Estate’s

shareholder returns

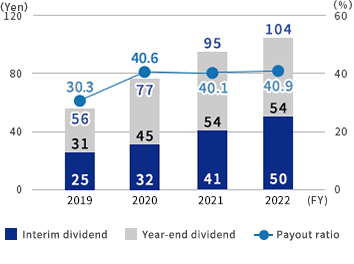

Basic policy on shareholder returns

The Company will return profits to shareholders based on the assumption that its businesses, particularly the redevelopment and building leasing businesses, will operate stably over the long term, and sufficient internal reserves for raising shareholder value will be secured. As a basic policy, the Company will aim for a consolidated total shareholder return ratio of 70% from fiscal 2020 to 2023 by drawing from returns on business investments while placing importance on the cost of capital and capital efficiency.

-

Annual Dividends per Share and Consolidated Payout Ratio